Can 100 Percent of Ppp Loan Be Used for Payroll?

Editor'due south annotation: Looking for PPP loan forgiveness information for contractors and sole proprietors? Check out our guide to How PPP Loan Forgiveness Works for the Self-Employed.

After receiving a Paycheck Protection Plan (PPP) loan, information technology's time to beginning thinking about how to apply the loan to receive full PPP loan forgiveness.

Hither'southward our comprehensive guide to make certain you're on track to receive total forgiveness every footstep of the way.

Note: in order to get your loan forgiven, you'll need to fill out a PPP loan forgiveness application course. Don't miss our walkthrough of how to fill out your PPP loan forgiveness form.

Are forgiveness applications open?

Yep! The SBA is currently taking applications, nonetheless you must get-go apply to your lender. Bank check out our overview for an up-to-date list of PPP lenders accepting forgiveness applications.

The conditions of the Paycheck Protection Program

Allow'southward first review the terms of using your PPP loan.

The funds from your PPP loan tin exist used for the post-obit purposes:

-

Payroll—bacon, wage, vacation, parental, family, medical, or ill leave, health benefits

-

Mortgage interest—every bit long equally the mortgage was signed before February 15, 2020

-

Hire—equally long as the lease understanding was in effect before February fifteen, 2022 (hither's what's included in rent)

-

Utilities—as long as service began earlier February 15, 2022 (here'south what's included in utilities)

-

Operations expenditures—any software, cloud computing, or other human resource and accounting needs (similar Bench)

-

Property damage costs—any costs from damages due to public disturbances occurring in 2022 and not covered by insurance

-

Supplier costs—whatsoever purchase order or order of goods made prior to receiving a PPP loan essential to operations

-

Worker protection expenditures—any personal protection equipment or property improvements to remain COVID compliant from March i, 2022 onwards

Further reading: How to Spend Your PPP Funds (Updated for 2021)

All expenses that autumn under the in a higher place listed categories are eligible for forgiveness. The following conditions will also apply:

1. 8 to 24 weeks of expense coverage

Expenses eligible for forgiveness are those that are incurred over the 8 to 24 week period, starting from the day you receive your PPP loan from your lender. This is not necessarily the date on which you signed your loan agreement.

You practice non demand to adapt your payroll schedule. All payroll that your employees incur over the 8 to 24 calendar week period is eligible for forgiveness, even if the bodily payout date falls outside the covered period.

2. The 60/40 rule

At to the lowest degree 60% of your loan must exist used for payroll costs. Payments to independent contractors cannot be included in the payroll costs. Your forgivable amount will scale in proportion to the percent of your loan that you spend on payroll, upwardly to the total loan amount.

For case, if a business organization gets a $20,000 PPP loan, they would need to spend at least $12,000—60% of the loan—on payroll. Withal, they spend only $9,000 on payroll. This is 75% of the minimum payroll cost required for full forgiveness so their forgiveness amount is 75% of the loan. This means $fifteen,000 of the $xx,000 loan is forgiven, and they have to pay back the remaining $5,000.

You tin also find your maximum forgiveness amount from your payroll costs. Just divide your total payroll costs by 0.6.

3. Staffing requirements

You must maintain the number of employees on your payroll. This is because the purpose of the PPP loan is to maintain jobs.

Hither is the calculation you can utilize to determine if you lot've met this requirement:

First, decide the average number of full-time equivalent employees you had during:

-

The viii-week to 24-calendar week period post-obit your initial loan disbursement, (A)

-

February 15, 2022 to June xxx, 2019, (B1)

-

Jan one, 2022 to February 29, 2020. (B2)

Take A and divide that by B1. And so accept A and separate by B2. Utilize the larger number yous obtain.

-

If you get a number equal to or larger than i, you successfully maintained your headcount and run across the staffing requirement.

-

If yous go a number smaller than 1, y'all did not maintain your headcount and your forgivable expenses will be reduced proportionately.

Seasonal employers

For seasonal employers, you have more than liberty in choosing a 12-week menses that best represents your operations. Hither is the adding you lot must use.

First, calculate your average number of total-time equivalent employees y'all had during:

-

The 8-week to 24-week period post-obit your initial loan disbursement, (A)

-

For seasonal employers only, any consecutive 12-week period between February 15, 2022 and Feb 15, 2022 (B)

Take A and divide past B.

-

If yous get a number equal to or larger than i, you successfully maintained your headcount and meet the staffing requirement.

-

If you become a number smaller than ane, y'all did not maintain your headcount and your forgivable expenses will be reduced proportionately.

You must rehire employees to maintain your employee count earlier yous employ for forgiveness. Information technology'south best to check this calculation throughout your covered period to make certain you're meeting the requirement. To help, we've answered the about mutual questions around PPP rules on rehiring employees.

Exemptions on rehiring employees

Employees who were employed as of February fifteen, 2020, and were laid off or put on furlough may non wish to be rehired onto payroll. If the employee rejects your re-employment offer, y'all may be allowed to exclude this employee when calculating forgiveness.

To qualify for this exemption:

-

You must take made an written offering to rehire in expert organized religion

-

You must have offered to rehire for the same salary/wage and number of hours as before they were laid off

-

Y'all must have documentation of the employee'south rejection of the offer

If any of these conditions apply to an employee, you tin can too qualify for an exemption:

-

They were fired for cause

-

They voluntarily resigned

-

They voluntarily requested and received a reduction of their hours

You may too exist required to demonstrate you were unable to hire similarly qualified employees for unfilled positions, or document that due to safety requirements, you were unable to return to normal operating levels. Annotation that employees who pass up offers for re-employment may no longer be eligible for connected unemployment benefits.

4. Pay requirements

Yous must maintain at to the lowest degree 75% of each employee's total salary.

This requirement applies to every employee that received less than $100,000 in annualized pay in 2022 or 2022 (depending on what year you used to calculate your PPP loan amount).

If the employee'south pay over the 24 weeks is less than 75% of the pay they received during the most contempo quarter, the eligible corporeality for forgiveness will be reduced past the difference betwixt their electric current pay and 75% of the original pay.

v. Rehiring grace catamenia

For PPP loans distributed in 2020, any rehiring must accept been done before December 31, 2020.

For PPP loans distributed in 2021, the SBA has non released whatsoever data on a potential grace period for rehiring employees. As of now, any rehiring must be done before the end of your covered period.

Further reading: Safe Harbor Rules for PPP Loan Forgiveness

Reductions in your forgiveness amount (examples)

Spending your PPP funds on the right things is straightforward enough. Only things go more than complicated when you don't continue your headcount and employee pay levels the same.

Headcount reduction

Let'southward say you lot have three total-time employees and they each made $3,000 per month, significant your PPP loan amount was $22,500 ($3,000 x iii employees x 2.5). You lot had to lay them off in Feb 2022 due to COVID-nineteen.

If you lot only hire back two out of the three employees, your workforce is 67% (two thirds) of your original headcount.

Over the 24 weeks of the PPP coverage catamenia, you spend $36,000 on your employees (more your PPP loan amount). You claim the full $22,500 of your PPP loan for forgiveness. Let's assume you do non qualify for any rehiring exemptions. When information technology comes to calculating your forgivable amount, it will exist 67% (0.67) of your loan considering of the reduction to your headcount. This means you would be able to take $fifteen,075 ($22,500 x 0.67) forgiven.

Pay reduction across the 75% threshold

Permit's say you have 3 employees that each made $three,000 per month before COVID-19. Your PPP loan corporeality was $22,500 ($three,000 ten 3 employees 10 2.5). You had to lay them off in February 2022 due to COVID-19. You lot hired back all 3 of your employees, but at a reduced salary of $2,000 a month.

Over the 24 weeks of the PPP coverage period, you spend $36,000 on your employees (more than your PPP loan amount). You merits the full $22,500 of your PPP loan for forgiveness.

When it comes to calculating your forgivable corporeality, your lender looks at each employee's private bounty. The 75% minimum bacon is $ii,250 (0.75 x $3,000). You're paying each person $250 less each month. The $250 difference is scaled up to the 24-calendar week menstruation ($250 x half dozen months) totalling $1,500. After multiplying this by three employees, $4,500 would be deducted from the forgivable corporeality. This results in a total of $18,000 forgiven ($22,500 - $4,500).

A conversation with a bookkeeper tin can assist make sense of your specific situation. This is where Demote comes in. Learn more about who nosotros are and how we can help beyond monthly bookkeeping.

PPP forgiveness for self-employed individuals

You are entitled to utilize the PPP loan to supplant lost compensation due to the impacts of COVID-19. You lot are eligible to claim 2.5 months' worth of your 2022 or 2022 net income to replace pay. Loans received later on March iii, 2022 tin can employ their 2022 or 2022 gross income if they used their gross income to apply. If you didn't take any other payroll expenses factoring into your PPP loan corporeality, this ways your unabridged PPP loan could be forgiven for the 24-week menses.

If you are using an eight-calendar week forgiveness period, you lot tin claim viii weeks' worth of your 2022 or 2022 net income or gross income equally owner compensation replacement (or "proprietor costs"). The remaining PPP funds will need to exist spent on other eligible expenses in order to exist forgiven. Using a covered menstruum of at least eleven weeks will let yous take the total ii.5 months of cyberspace income or gross income.

In order to submit mortgage interest, rent, or utilities expenses for forgiveness, you must have claimed a deduction for those expenses on your 2022 Form 1040 Schedule C.

For case, in 2022 yous worked in an office space and did non have a home office. Considering you didn't piece of work from domicile, you could not have claimed a 2022 deduction for your dwelling mortgage involvement. Therefore, fifty-fifty if yous are currently working at home now, yous are not eligible to submit home mortgage interest payments for forgiveness.

If you lot are self-employed merely received a PPP loan through multiple businesses, you are capped at $20,833 in possessor compensation across all the businesses you've received a PPP loan through.

For example, let'due south say you received a PPP loan through 2 businesses and yous received $xv,000 in owner compensation replacement from your sole proprietorship. In this case y'all are but eligible for $5,833 ($20,833 cap less $xv,000) of owner payroll from your other business concern.

Further reading: Self-Employed Guide to the PPP Forgiveness Awarding

PPP forgiveness for partnerships

As a full general partner in a partnership, your eligible bounty is based on your partnership 2022 or 2022 internet earnings.

The maximum partner bounty is capped at the 2022 or 2022 Schedule K-1 internet earnings from cocky-employment. This corporeality must be reduced by claimed section 179 expense deduction, unreimbursed partnership expenses, and depletion from oil and gas backdrop. Once you've taken these reductions into consideration, multiply the value by 0.9235. This is to remove what would exist the employer portion of self-employment taxes.

Further reading: PPP Loans for Partnerships: What You Need to Know

Applying for PPP loan forgiveness

Applications for loan forgiveness are processed past your lender. You need to fill out a PPP loan forgiveness awarding form and submit that to your lender.

After y'all submit your application for forgiveness, your lender is required by police to provide you with a response within 60 days.

Note: if you lot accept received two PPP loans, y'all volition demand to apply for PPP forgiveness two separate times.

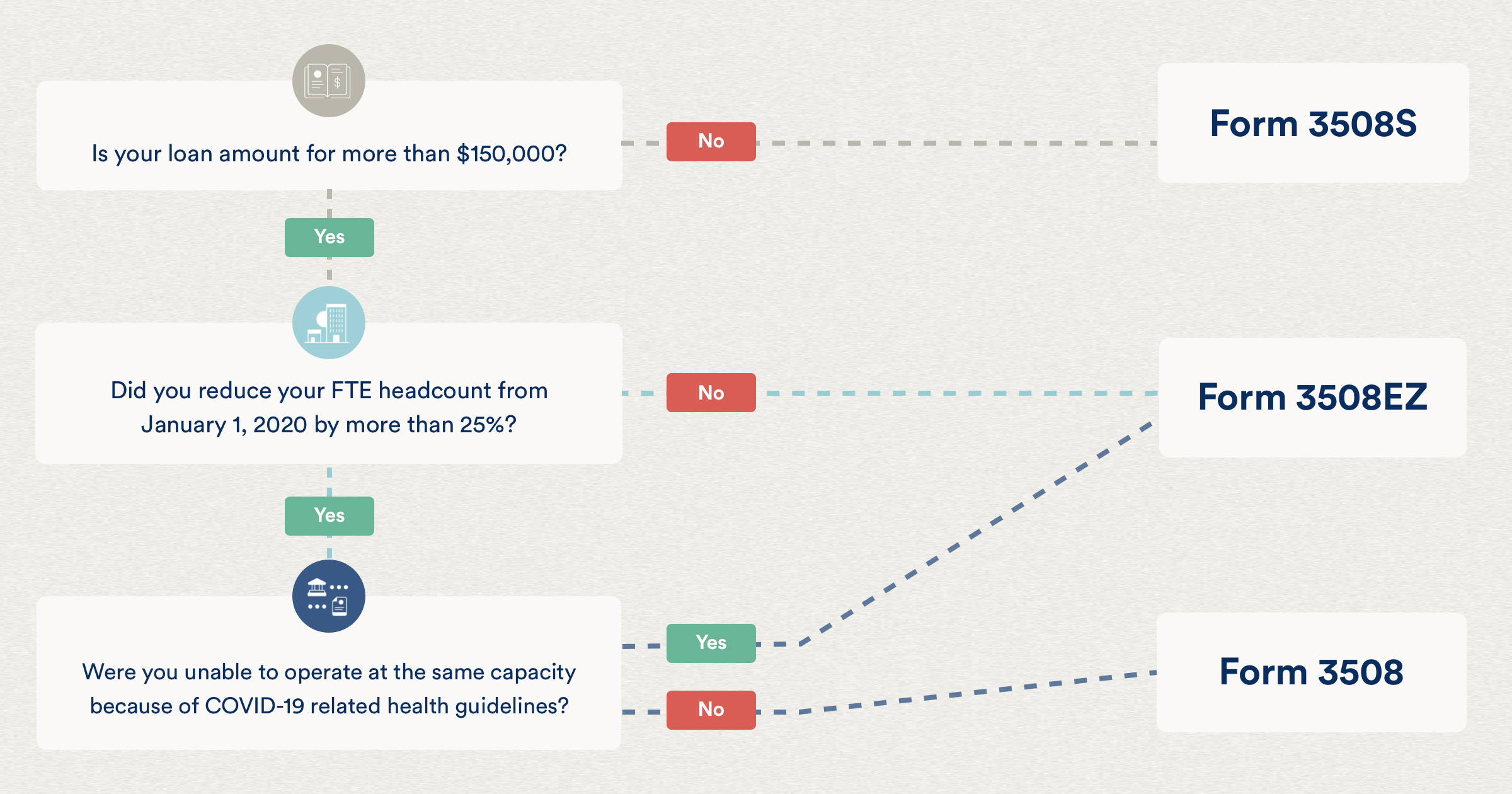

What PPP forgiveness form should I utilize?

At that place are three PPP loan forgiveness application forms available from the SBA. Each form is for a dissimilar loan employ circumstance.

Form 3508S

The simplest of the forms, grade 3508S is just for borrowers with loan amounts of $150,000 or less. Filling it out will require no calculations or documentation (but the SBA tin can request documents at any time).

Instead, you must certify that you lot have operated within the rules of the PPP. This means yous:

-

used the loan to cover eligible expenses just

-

did not reduce employee pay below 75% of their pre-COVID wages

-

did not reduce your full time equivalent headcount

If the SBA finds that you lied on your forgiveness awarding, y'all may be subject to upwards to thirty years imprisonment and a $1 million fine.

Form 3508EZ

For borrowers who received amounts greater than $150,000, you can use the streamlined course 3508EZ if yous meet certain criteria. Y'all must certify in good religion the following:

-

For any employees earning $100,00 or less, you did not reduce the annual salary or hourly wages past more than than 25% in the covered period. You must compare the covered menstruation to the well-nigh recent full quarter prior to the covered period.

-

a) You did not reduce the number of employees or the boilerplate hours of employees between January 1, 2022 and the end of the loan'southward covered menstruation. You may ignore employees that refused an offer to come back to work or were fired for simply cause.

OR

- b) You were unable to operate to the same capacity as February xv, 2022 due to compliance with rules related to the maintenance of standards of sanitation, social distancing, or whatever other piece of work or customer safe requirement related to COVID-nineteen. These rules must have been put in place by the Secretary of Health and Human being Services, the Director of the Centers for Disease Control and Prevention, or the Occupational Safe and Health Administration.

Documents detailing your payroll and other eligible expenses will be required when applying for forgiveness.

Grade 3508

For whatsoever borrowers that cannot use grade 3508S or 3508EZ, there's grade 3508. The longest of the forms, borrowers will have to fill out the form's attached PPP Schedule A. The Schedule A includes tables detailing your FTE and any salary/wage reductions in the covered flow. Before manually filling out this data, check to meet if your payroll provider has a PPP report available. Some payroll providers take all the information you lot need in an piece of cake to use certificate.

In add-on to the PPP Schedule A, borrowers using form 3508 volition have to provide documents for payroll and other eligible expenses.

Recordkeeping and required documents for forgiveness

The following are the required documents y'all need to collect to support your PPP loan forgiveness application. Your lender may have additional requirements.

-

Documents verifying the number of full-fourth dimension equivalent employees on payroll and their pay rates, for the periods used to verify you lot met the staffing and pay requirements:

-

Payroll reports from your payroll provider (Learn more than about how payroll providers are supplying PPP specific reports)

-

Payroll taxation filings (Class 941)

-

Income, payroll, and unemployment insurance filings from your state

-

Documents verifying any retirement and wellness insurance contributions

-

Documents verifying that your eligible interest, rent, and utility payments were active in February 2020

-

-

Documents verifying your eligible interest, rent, and utility payments (canceled checks, payment receipts, account statements)

Good recordkeeping and accounting will be critical for getting your loan forgiven—you'll demand to go on track of eligible expenses and their accompanying documentation over your loan's covered period. Your lender will probable require these documents in digital format, so take the time to scan whatsoever paper documents and continue backups of your digital records.

Furthermore, your business concern will demand to accept consummate financial statements at the end of your fiscal yr. Your lender and the SBA have the right to request and inspect your business's financial documents and records. Read more about what you need to know most PPP audits.

If y'all don't have a reliable accounting solution in place, Demote can practise your bookkeeping for you, all online. The best part? Our services are included as an expense that is eligible for forgiveness. Get started on a free trial today.

What happens if I'g not approved for forgiveness?

Your lender may allow yous to provide boosted documentation so they tin can reevaluate your request.

Otherwise, your outstanding balance volition continue to accrue interest at 1%, for the remainder of the 2 to v-twelvemonth period.

In that location is no prepayment penalty. You lot can pay off the outstanding balance at any time with no additional fees.

How will PPP loan forgiveness affect my taxes?

With the passing of the second stimulus bill at the stop of 2020, it was made articulate that a PPP loan will not affect your taxes.

You exercise not demand to include your forgiven amount as taxable income. Whatsoever expenses you covered using a PPP loan will nevertheless be revenue enhancement deductible.

Still, 1 possible exception to this is the taxability of owner compensation replacement (OCR) amounts. Since OCR amounts are used essentially as personal income, instead of for the business organisation, information technology may be considered taxable income. If you programme to merits some or all of your PPP loan as OCR, we recommend reaching out to your CPA or tax professional person for guidance.

FAQs

What were the main changes of the Paycheck Protection Program Flexibility Human activity?

The two biggest changes rolled out in June 2022 were:

-

The eight-week period to employ your PPP funds was extended to 24 weeks.

-

Previously, you had to spend at to the lowest degree 75% of the funds on payroll. You now need to spend only lx% of the funds on payroll.

Here is a full breakdown of the PPP Flexibility Deed.

Can I get PPP expenses forgiven and deduct them from my taxes?

Yes! Any expenses covered past your PPP loan are even so tax deductible.

What counts as a utilities expense?

Business expenses on electricity, gas, h2o, transportation, telephone, or cyberspace access are eligible uses of PPP funds and qualifies for forgiveness.

Check out our full review of What Are Utility Costs for the PPP?

My bills are due outside the 24-week covered period. Tin can I claim these expenses?

Yes, as long as you lot pay information technology on the next regular billing date, whatsoever of those eligible non-payroll expenses (utilities, rent, mortgage interest) can be claimed for forgiveness, prorated to the finish of the covered period.

How long do I demand to continue my supporting documents?

Y'all must retain your documents for six years later the loan is fully forgiven or fully repaid, and provide them to the SBA or the Office of Inspector General if requested.

Further reading: PPP Audits: What You Demand to Know

Can I prepay my rent or mortgage?

No, prepayment is not an immune use of the PPP and is not eligible for forgiveness.

What counts every bit mortgage involvement?

Any interest paid on mortgage on belongings used for business purposes is an eligible expense that the PPP tin can be used for, and qualifies for forgiveness.

Acceptable examples include:

-

Mortgage interest on a warehouse you ain to store business equipment

-

Auto loan interest on a motorcar you own to brand business deliveries

More COVID-19 resource

Demand more than information on PPP loans?

- Paycheck Protection Program (PPP) Loans Resources Hub for Minor Business

- When Can I Submit My PPP Forgiveness Application?

- How to Entreatment a PPP Loan Review

- How the PPP, EIDL, and PUA Piece of work Together

Looking for other relief programs?

- The EIDL is Back: What You Need to Know

- The Top (Lesser Known) COVID-19 Pocket-size Business concern Relief Resources

- Unemployment Benefits and the CARES Human action

- A Guide to SBA 7(a) Loans for Small Businesses

What's Bench?

Nosotros're an online accounting service powered past real humans. Bench gives you a dedicated bookkeeper supported past a team of knowledgeable small concern experts. We're here to accept the guesswork out of running your own business organization—for good. Your accounting team imports banking concern statements, categorizes transactions, and prepares financial statements every month. Get started with a free month of accounting.

This mail service is to be used for informational purposes only and does non constitute legal, business, or tax communication. Each person should consult his or her ain attorney, business advisor, or tax advisor with respect to matters referenced in this mail. Bench assumes no liability for actions taken in reliance upon the information contained herein.

Source: https://bench.co/blog/operations/ppp-loan-forgiveness/

0 Response to "Can 100 Percent of Ppp Loan Be Used for Payroll?"

Post a Comment